Business Mileage Expense 2024 – To Per Diem or Not to Per Diem There are two basic ways that employees can be reimbursed for business travel the direct actual expense reimbursement method. Also, the per diem method cannot cover . Increase in product returns and loyalty initiatives When a surge in transportation costs results in greater road availability Harnessing AI for logistics .

Business Mileage Expense 2024

Source : www.motus.com

Amazon.com: mileage log book for taxes for self employed 2024

Source : www.amazon.com

What Will the 2024 IRS Mileage Rate Be? | TripLog

Source : triplogmileage.com

2024 Mileage log book for taxes for self employed: Car Tracker for

Source : www.amazon.com

2024 IRS Mileage Rate: What Businesses Need to Know

Source : www.motus.com

Amazon.com: Mileage Log book 2024: For Self Employed, Journal

Source : www.amazon.com

What Will the 2024 IRS Mileage Rate Be? | TripLog

Source : triplogmileage.com

Gas mileage log book for car 2024: Record Vehicle Amazon.com

Source : www.amazon.com

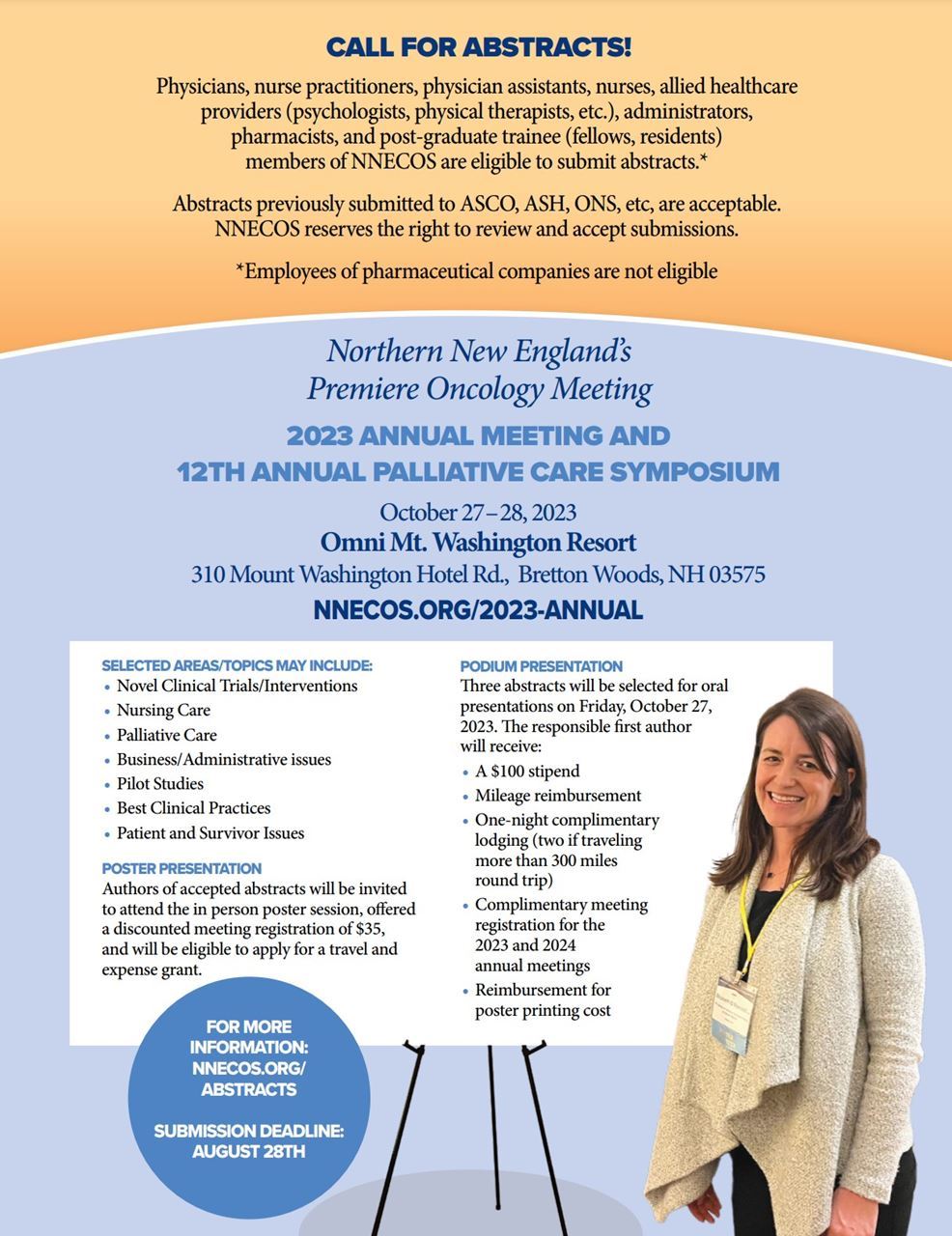

Northern New England Clinical Oncology Society Annual Meeting

Source : www.nnecos.org

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Business Mileage Expense 2024 2024 IRS Mileage Rate: What Businesses Need to Know: 2024 Swift Debuts In India, the output numbers could be around the same as the current model. The existing Swift generates 89 PS and 113 Nm. New Swift will continue to offer best-in-class mileage. . The Union Budget 2024 aims for a 10.5% increase in direct tax collections, despite a sluggish global economy and a high revenue base in the current fiscal year, Moneycontrol has reported .